Looking to 2023, income investors can’t ignore the tax-effective benefits of franking credits, and by extension of that, we think investors can ignore much of the scaremongering surrounding the future of franking credits.

In 2022 there were two key announcements from the Government regarding franking.

The first was draft legislation proposed in September preventing franking credits being attached to company distributions funded by a capital raisings. We see this as logical policy which will help protect the long-term integrity of the franking credits system. Not any of the additional income we delivered clients in franking credits in 2022, none came from distributions funded by capital raisings.

The second proposed change came in the October federal budget. Treasurer Jim Chalmers announced the tax treatment of off-market share buybacks would be aligned with on-market buybacks, meaning it’s likely no franking credits will be received by investors who participate in buybacks.

It’s true off-market buybacks provided some additional income to retirees and while we don’t support this move, we don’t believe it will have a major impact on retirement income.

Of the 9.8% income our Plato Australian Shares Income Fund has delivered since inception (including dividends and franking credits), off-market buybacks have been just a small part of that franking component, and importantly this move only impacts shareholders willing to sell their shares.

The bread and butter of franking income for Australian investors over many decades has come from sustainable dividend distributions by companies with strong balance sheets and quality management. This will not stop and there are no proposed changes to this.

Through active portfolio management and astute stock selection, there is no reason why income investors should not be able to maintain their historical level of average annual franking credit income, despite this change.

There is also a reasonable argument to make that because companies can no longer do off-market buybacks, they may pay out generally higher dividends and franking, given there will be no way to do this through off-market buybacks anymore. Companies have an incentive to distribute all the franking credits on their balance sheet – now they’ll only be able to do that with dividends.

So, in 2023 franking credits are here to stay (despite the hyperbole) and companies paying fully franked dividends can’t be ignored.

For every one dollar of income received from fully franked dividends by pension-phase and other tax-exempt investors, an additional 43 cents on top in franking is received.

Plato’s modelling is projecting that at an index level in 2023 the ASX200 will deliver a cash yield of 4.4%, and 6.0% when including franking credits. On top of this, we think active and tax-effective portfolio management will deliver significant additional income.

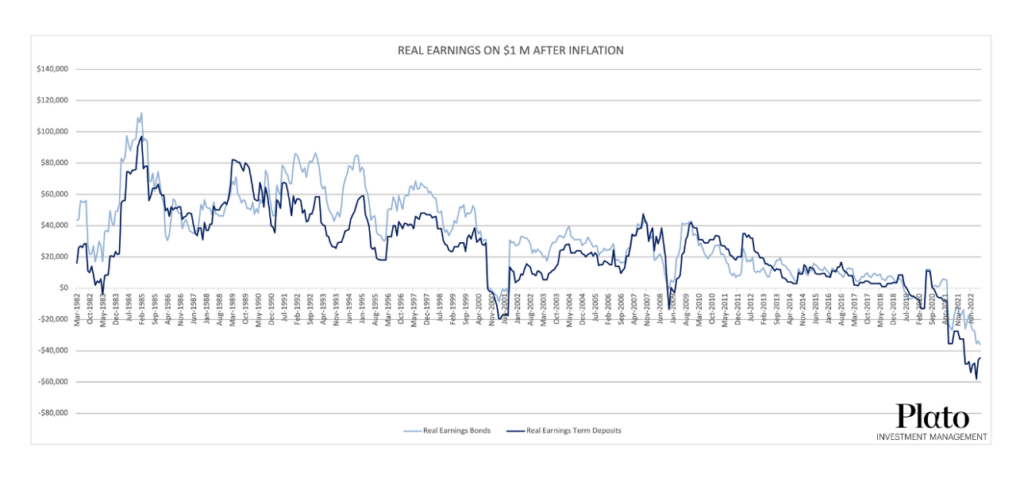

This is as term deposits and bonds continue to lose money in real terms (adjusted for inflation), as highlighted in the chart below.

Source: Plato, RBA. Updated on 30 September 2022.

SUBSCRIBE TO OUR NEWSLETTER FOR MORE INCOME INVESTING INSIGHTS

SUBSCRIBEDISCLAIMER:

This document is prepared by Plato Investment Management Limited ABN 77 120 730 136, AFSL 504616 (‘Plato’). Pinnacle Funds Services Limited ABN 29 082 494 362, AFSL 238371 (‘PFSL’) is the product issuer of the Plato Australian Shares Income Fund (‘the Fund’). The Product Disclosure Statement (‘PDS’) of the Fund is available at https://plato.com.au/. Any potential investor should consider the relevant PDS before deciding whether to acquire, or continue to hold units in, a fund. The Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) of the Fund is available at https://plato.com.au/. Pinnacle Fund Services Limited is not licensed to provide financial product advice.

Plato and PFSL believe the information contained in this document is reliable, however no warranty is given as to its accuracy and persons relying on this information do so at their own risk. This communication is for general information only and was prepared for multiple distribution and does not take account of the specific investment objectives of individual recipients and it may not be appropriate in all circumstances. Persons relying on this information should do so in light of their specific investment objectives and financial situations. Any person considering action on the basis of this communication must seek individual advice relevant to their particular circumstances and investment objectives. Subject to any liability which cannot be excluded under the relevant laws, Plato and PFSL disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information.

Any opinions or forecasts reflect the judgment and assumptions of Plato and its representatives on the basis of information at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future. The information is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. Past performance is not a reliable indicator of future performance.

Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this document is prohibited without obtaining prior written permission from Plato. Plato and their associates may have interests in financial products mentioned in the presentation.

Plato Investment Management Limited (‘Plato’) (ABN 77 120 730 136, AFSL 504616) is the investment manager of Plato Income Maximiser Limited (‘PL8’ or the ‘Company’) (ACN 616 746 215). PL8 is the issuer of the shares in the Company under the Offer Document. Any offer or sale of securities are made pursuant to definitive documentation, which describes the terms of the offer (‘Offer Document’) available at https://plato.com.au/lic-overview/ This communication is not, and does not constitute, an offer to sell or the solicitation, invitation or recommendation to purchase any securities and neither this communication nor anything contained in it forms the basis of any contract or commitment. Prospective investors should consider the Offer Document in deciding whether to acquire securities under the offer. Prospective investors who want to acquire under the offer will need to complete an application form that is in or accompanies the Offer Document. The Offer Document is an important document that should be read in its entirety before deciding whether to participate in the offer. Prospective investors should rely only on information in the Offer Document and any supplementary or replacement document. Prospective investors should contact their professional advisers with any queries after reading the Offer Document. Any opinions or forecasts reflect the judgment and assumptions of Plato and its representatives on the basis of information at the date of publication and may later change without notice. The information is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. This communication is for general information only. It has been prepared without taking account of any person’s objectives, financial situation or needs. Any persons relying on this information should obtain professional advice relevant to their particular circumstances, needs and investment objectives. Past performance is not a reliable indicator of future performance.